Saving Chart Bi Weekly

Use this Money Savings Chart to save an extra 1,000 this year! It's

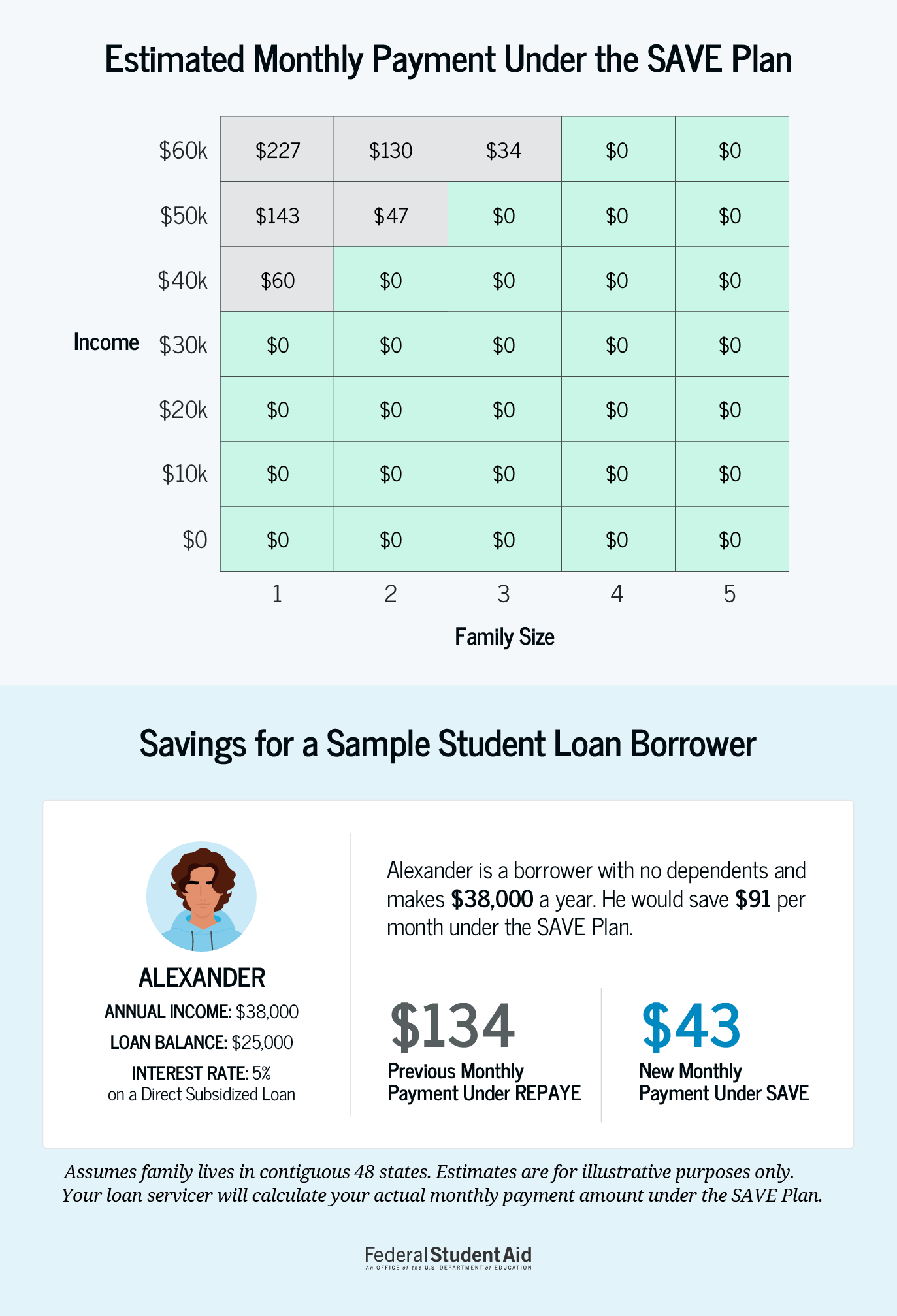

The SAVE plan offers the lowest monthly payments of any income-driven repayment plan out there — even triggering a $0-a-month payment for those living on limited budgets. Payments are based.

Pick one Monthly Savings Challenges to find success Money Bliss

The SAVE plan, which is available to student borrowers with a Direct Loan in good standing, will replace the existing Revised Pay-As-You-Earn (REPAYE) plan which is the most generous existing IDR plan for most borrowers.

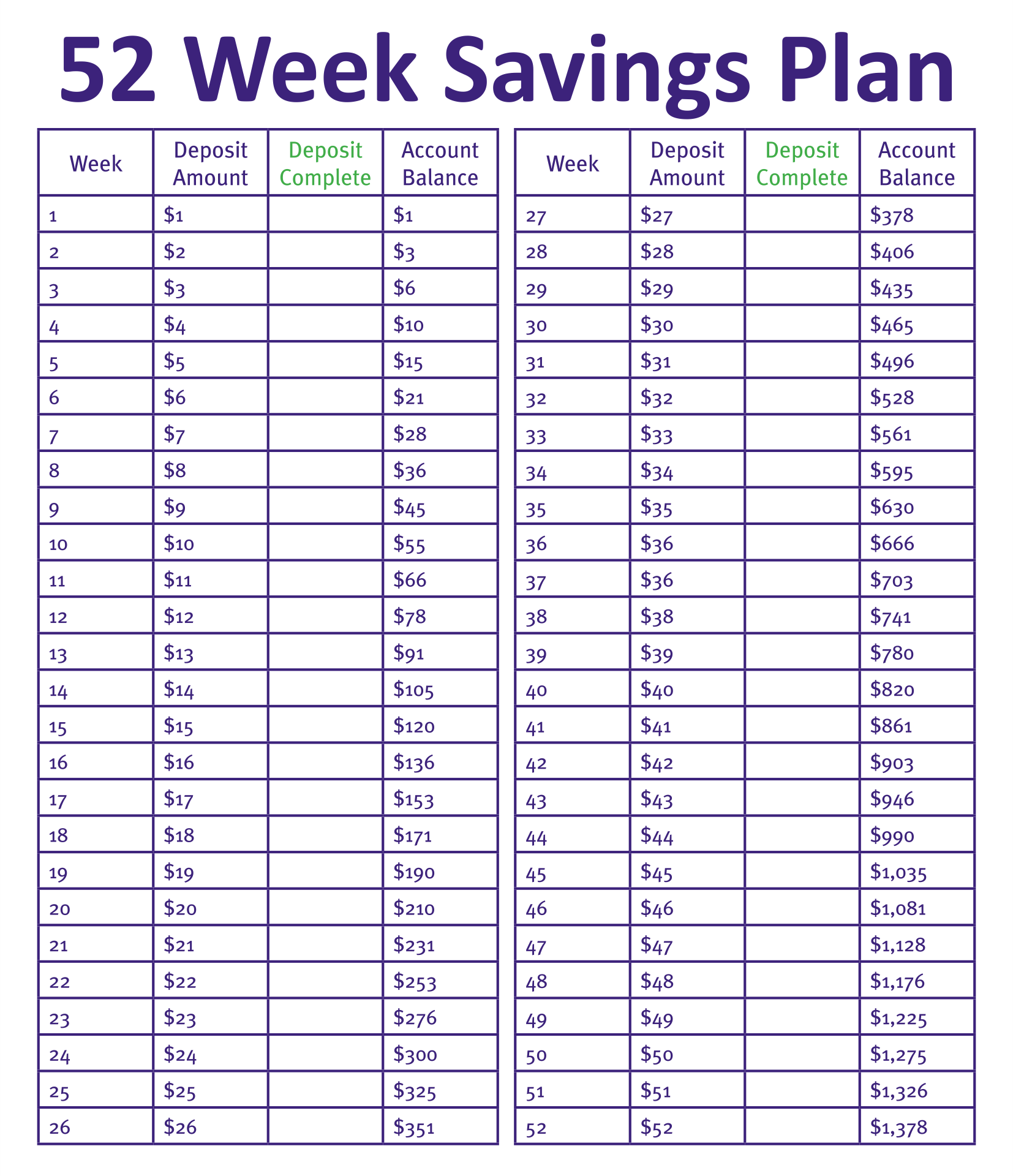

52 Week Money Saving Chart template has a simple design and its

Specifically, the SAVE Plan reduces the percentage of discretionary income that can be used toward loan repayment to 5% from 10% for undergraduate loans (graduate loan payments are still capped at.

Printable 1 Year Money Saving Goal Sheet 2500 Money saving challenge

Your session will time out in: 0 undefined 0 undefined. End My Session

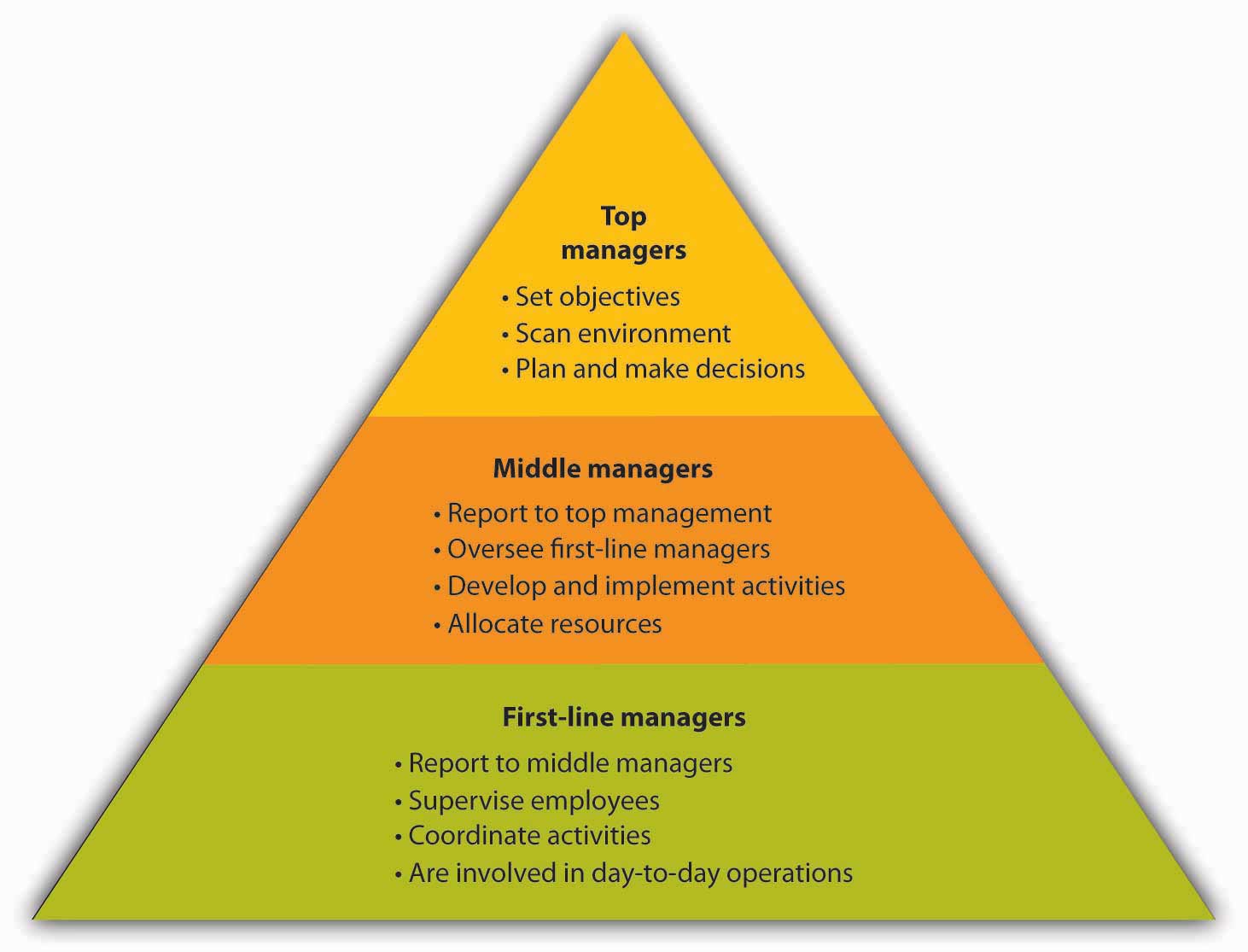

Reading Organizing Introduction to Business

Chief among them is President Biden's new income-driven repayment plan — Saving on a Valuable Education plan, commonly known as SAVE — which ties monthly payments to earnings and family size.

challenge printable vacation reverse savings through saving

The SAVE Plan, like other income-driven repayment (IDR) plans, calculates your monthly payment amount based on your income and family size instead of on the balance of your student loan. The SAVE Plan provides the lowest monthly payments of any IDR plan available to most borrowers. By enrolling in the SAVE Plan now, you will

How to Save 5000 in 26 Weeks A Simple Biweekly Savings Plan Money

SAVE: The New Biden IDR Plan. President Biden established a new IDR repayment plan for student loans that's better for borrowers in most situations than the existing PAYE and IBR plans. Here are some of the main highlights:. That's why the relevant takeaway when looking at this chart is the cost in today's dollars. Example 2: Slim chance.

Best Student Loan Calculator + Free Excel Repayment Plan Template

Student Loan Forgiveness Calculator (w/ New SAVE Plan) This student loan forgiveness calculator, updated with the new SAVE program (formerly known as REPAYE), compares new and old income-driven repayment (IDR) plans and alternative repayment options.

Money Saving Strategies, Money Saving Plan, Entrepreneur Magazine

With the SAVE plan, even borrowers who don't qualify for a $0 monthly payment can still save at least $1,000 a year compared with other IDR plans, ED says. Plus, you won't owe excess interest.

Save Plan. Save. Retire. MyFloridaCFO

The new plan, known as SAVE (Saving on a Valuable Education), substantially reduces monthly payment amounts compared to previous IDR plans, and reduces time to forgiveness to as little as 10 years.

The Best Vacation Savings Plans With Free Printables Vacation savings

While other income-driven repayment plans use 100% to 150% of the poverty guideline, the SAVE plan uses 225%. That means more of your income is exempt, so you should have lower monthly payments as a result. On SAVE, a single borrower who earns $32,800 or less or a family of four earning $67,500 or less will have payments of $0 in most states.

Print Off This Checklist & Save 100 This Month Money saving

The Saving on a Valuable Education (SAVE) Plan is the newest income-driven repayment (IDR) plan. Like other IDR plans, the SAVE Plan calculates your monthly payment amount based on your income and family size. In addition, the SAVE Plan has unique benefits that will lower payments for many borrowers.

""

With the Saving on a Valuable Education (SAVE) Plan, families and individual borrowers with low or middle incomes will typically have lower monthly payments compared to other IDR plans. You can apply for the SAVE Plan now. This new IDR plan replaced the Revised Pay As You Earn (REPAYE) Plan.

Valentines Day Savings Save 280 Savings Challenge Etsy Saving Money

Our Income-Based Repayment calculator compares existing income-driven plans to the new SAVE plan finalized by President Biden in June 2023. This calculator also uses the latest 2023 federal poverty line numbers. What is your family size? (including unborn children) List the smaller of your prior year AGI or your current income.

Sustainability Plan

The SAVE plan is an income-driven repayment (IDR) plan that calculates payments based on a borrower's income and family size - not their loan balance - and forgives remaining balances after a.

13 Best Printable 52 Week Saving Chart

Here are three drawbacks of the SAVE plan: 1. Borrowers with mid-level balances don't stand to benefit as much. Your monthly payment on the SAVE plan is income-driven, whereas your monthly.