Deutsche, UBS fall on financial crisis worries

DEUTSCHE BANK i CDS, la speculazione e Lehman Brothers

Deutsche Bank CDS 1 Year EUR (DB1YEUAM=R) Xetra Create Alert Add to Watchlist 50.02 +0.00 +0.00% 04/01 - Closed. ( Disclaimer ) Type: Bond Group: CDS Market: Germany Prev. Close: 48.02 Day's.

CDS the role in the Deutsche Bank disaster (not only) Breaking

Of Deutsche Bank's CDS contracts, the most actively traded were the dollar denominated, five-year swaps tied to the lender's senior debt, with at least $51 million notional in the two days.

Deutsche, UBS fall on financial crisis worries

For the vast majority of securities traded in Canada, CDS is there. In 1970, that meant providing clearing, depository and settlement services for approximately 6,000 exchange trades per day. Today, processing volumes exceed 1.6 million exchange trades daily. We have built our business on a foundation of reliability and assume responsibility.

Una misteriosa mano tumbó la acción de Deutsche Bank con una pequeña

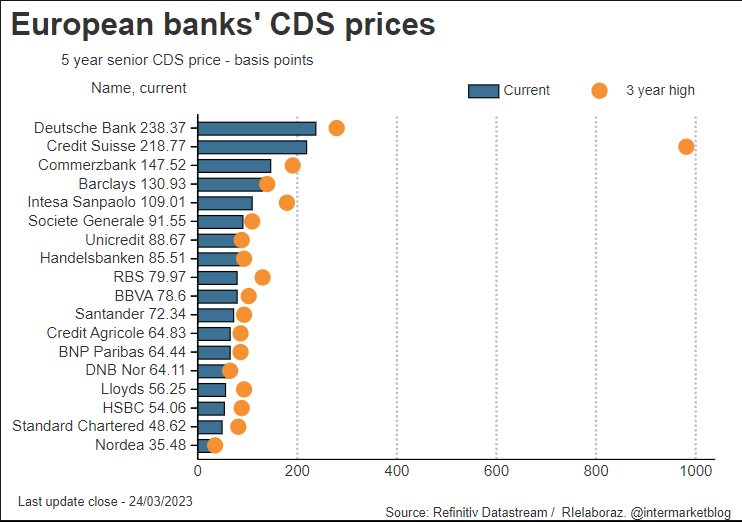

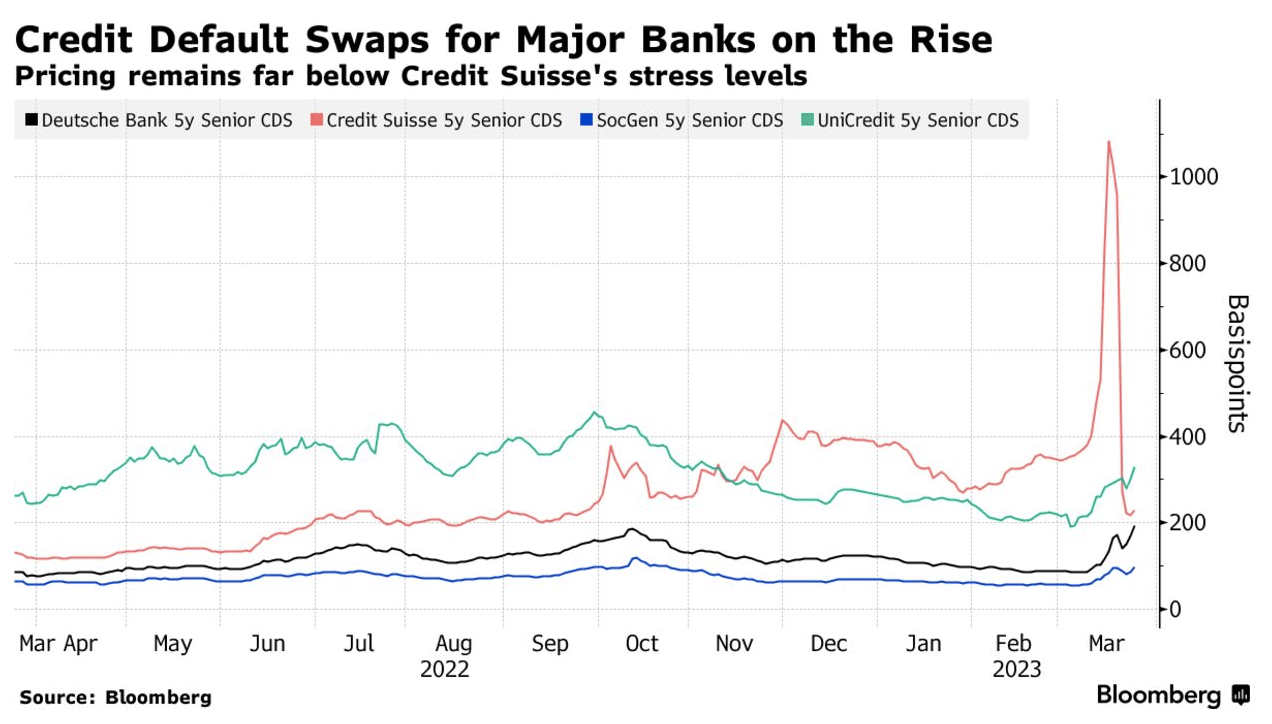

Deutsche Bank's credit default swaps (CDS) - a form of insurance for bondholders - shot up above 220 basis points (bps) - the most since late 2018 - from 142 bps just two days ago, based on.

Crisis Alert Is Deutsche Bank the Next Lehman Brothers?

Published: 09:29 24 Mar 2023 GMT European banking share prices came under fresh pressure on Friday as a spike in the cost of Deutsche Bank's credit default swaps (CDS) sparked renewed.

Deutsche Bank An Urgent Risk Assessment (Rating Downgrade) (NYSEDB

Deutsche Bank noted that Fed tightening has already pushed credit card delinquencies up to their highest in 12 years, while fueling unrealized losses on bond investments made when interest rates.

Credit Default Swaps Show Liquidity Risks Remain Financial Sense

Mar 24, 2023 - Economy Deutsche Bank stock falls amid "dragnet on global banks" Nathan Bomey , author of Axios Closer Illustration: Annelise Capossela/Axios Deutsche Bank — ever the source of global financial drama — took center stage once again as soaring default insurance costs and a slumping stock converged with bank sector fears.

Deutsche Bank Credit Default Swaps

Deutsche Bank has reported 10 straight quarters of profit, after completing a multibillion euro restructure that began in 2019, with the aim of reducing costs and improving profitability. The.

Deutsche Bank CDS jump 21 basis points after stability concerns Reuters

(Krisztian Bocsi/Bloomberg) Shares in Deutsche Bank fell sharply on Friday, as fears about vulnerabilities in Germany's largest lender sent investors for the exits. Deutsche Bank shares.

CDS Deutsche Bank, rischio fallimento

Credit Suisse CDS peaked at more than 1,000 basis points, or around 5x the level Deutsche Bank CDS are trading right now. In other words, the market priced in a much higher likelihood of a CS.

Regulators Blame Friday's Deutsche Bank Crash On Single CDS Trade

Data from Markit showed that five-year subordinated credit default swaps (CDS) for Deutsche Bank rose 85 basis points from Wednesday's close to a record high of 540 basis points, whilst one-year.

Nico Green (realsunflower34) / Twitter

Still, shares in Germany's largest bank have lost a fifth of their value so far this month and the cost of its five-year credit default swaps (CDS) - a form of insurance for bondholders -.

Deutsche Bank, una sui Cds dietro al crollo WSI

Soon after, one CDS trade tied to Deutsche Bank triggered a global market selloff. CDS are a type of derivative, which is a contract whose value is derived from price movements of an underlying.

Deutsche Bank crolla del 13 dopo il balzo dei Credit Default Swap

Price. Chg. Chg. %. Deutsche Bank CDS. 47.52. -0.01. -0.02%. Get instant access to a free live streaming chart for Deutsche Bank CDS 1 Year EUR Bond Yield.

Deutsche Bank Ends Most CDS Trade WSJ

On Friday morning, the spread between buying and selling prices for CDS on Deutsche Bank's subordinated five-year debt had widened by 42 basis points to 510 basis points. Equivalent CDS on.

Crisis Alert Is Deutsche Bank the Next Lehman Brothers?

Deutsche Bank Aktiengesellschaft's 5-year CDS spike has shocked the market amid fears of a credit event. Our analysis showed that credit insurance rates were bound to spike amid an ongoing.