GST Number Search Tool GSTIN Verification Online TranZact

How to Complete a Canadian GST Return (with Pictures) wikiHow

To get your business's GST number, simply contact the Canada Revenue Agency to begin the application process. The process is incredibly convenient, as there are three different ways to apply: • Online. • By mail. • By phone. You can apply for your GST number online by heading to Business Registration Online, or BRO.

How to Complete a Canadian GST Return (with Pictures) wikiHow

Open or manage an account Register for, change, or close a GST/HST account. Charge and collect GST/HST Determine which rate to charge, manage receipts and invoices, and learn what to do with the tax you collect. Complete and file a GST/HST return Calculate your net tax, and complete, file, or correct a return. Remit (pay) the GST/HST you collected

What is GST Number? How to Verify & Find by Name, Number & Format

How To Look Up a QST Number Quebec has its own registry for looking up Quebec Sales Tax (QST) numbers, managed by Revenu Québec. Residents of Quebec must use this system to look up a QST number. A QST number can be found by following these steps: Visit the official website of Revenu Québec, the tax authority that administers the QST.

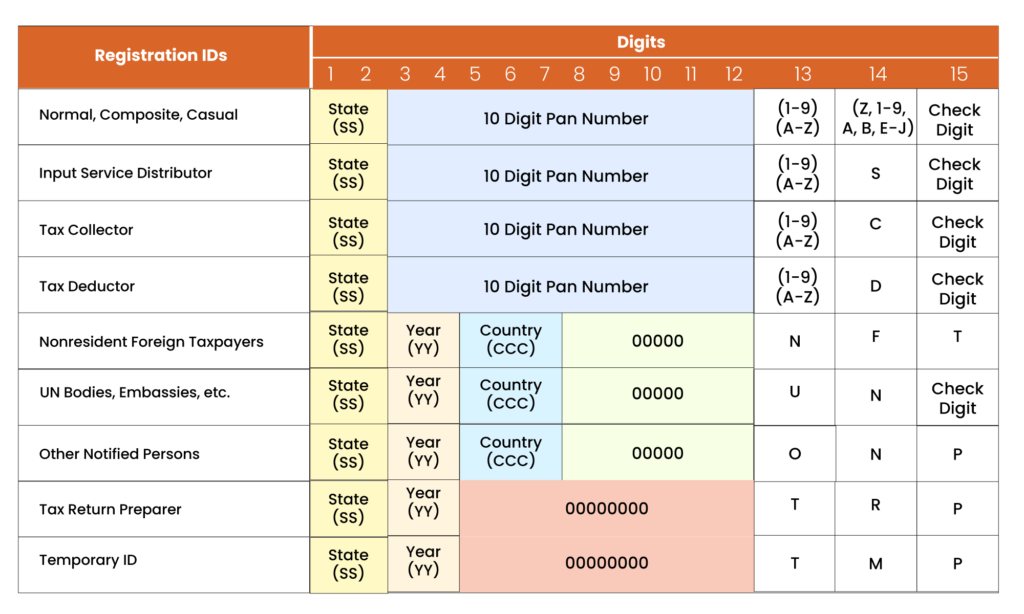

What is GSTIN, GST Number Format, GSTIN verification Process

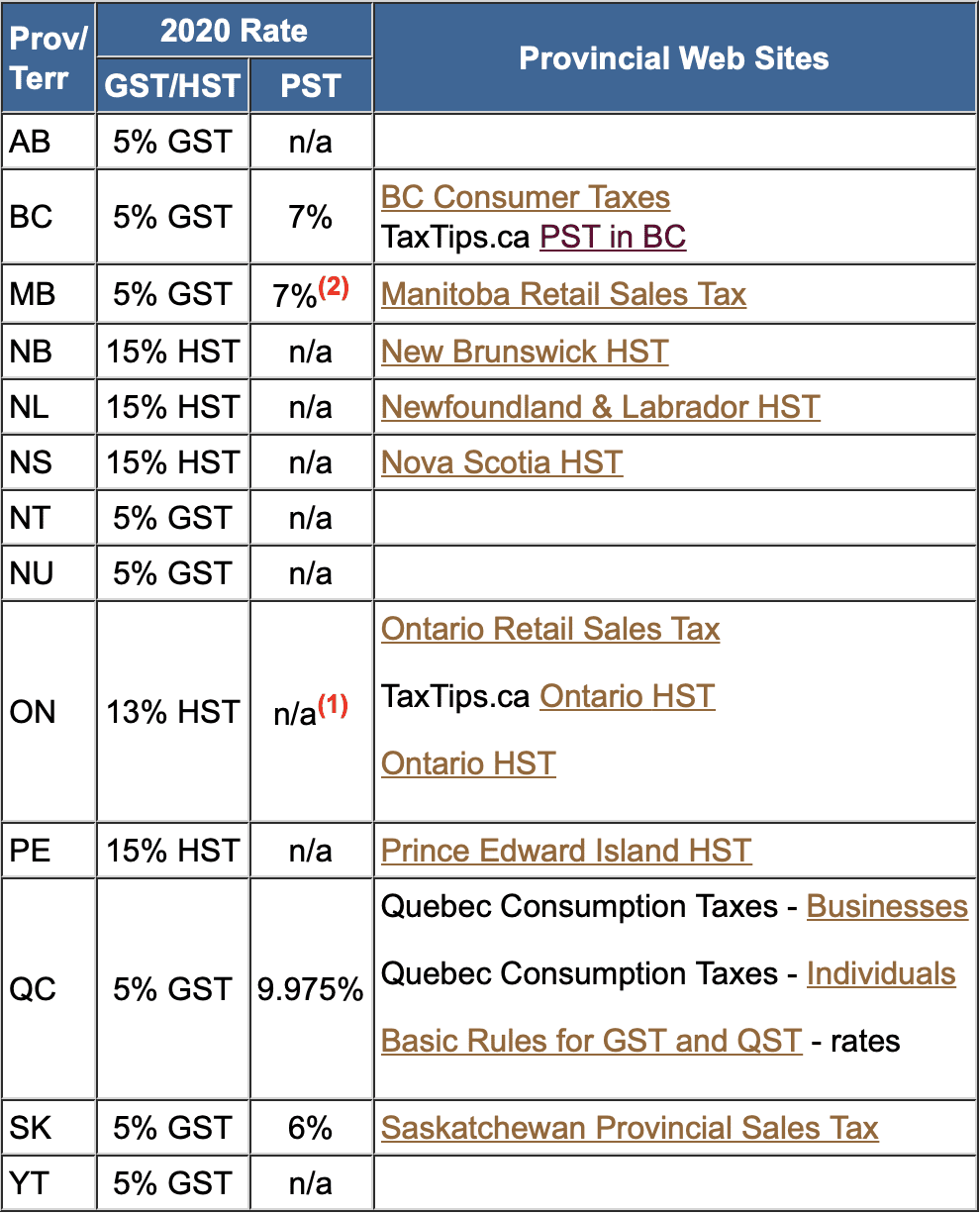

Ontario - HST 13% Prince Edward Island - HST 15% As a result, businesses operating under the HST program will have to submit one lump sum of the tax liability to the Canada Revenue Agency, instead of splitting the tax rate into GST and PST separately.

What is a GST/HST number and do I need one?

Canada.ca Taxes Digital services Digital services for Businesses Confirming a GST/HST account number On this page: How to confirm a GST/HST account number What you need to know before using the GST/HST Registry What to do after confirming the GST/HST account number Start a GST/HST Registry search How to confirm a GST/HST account number

GST Number Search Tool GSTIN Verification Online TranZact

Start a GST/HST registry search Types of businesses listed in this registry This registry lists digital economy businesses who have applied to be registered for the simplified GST/HST and have been issued GST/HST numbers by the CRA. Registration requirements are based on which digital economy measure applies to the business.

GST Number Search By Pan Number 2021 GST No Search by Pan gst

Canada operates a range of Goods & Services Tax (GST) across the Federal and 13 Provinces. The rules for GST broadly follow the European Union and OECD VAT models. GST was introduced into Canada in 1991. Federal GST is levied by the Canadian Revenue Agency, and the tax code is contained within the Excise Acts. Although Quebec's GST is under.

GST Number Search By Pan Number 2021 GST No Search by Pan gst

Updated over a week ago. If you have already registered the GST/HST number for your company, and you wish to confirm this information, you can do so on the Government of Canada website. You can also search for the GST/HST number for a different business on that site. If you have not yet registered for the GST/HST number, please see instructions.

How to Register for GST HST in Canada 2022 for Your Small Business by

A Federal Business Number (BN) is a 9-digit number which Revenue Canada Agency assigns to a business such as a corporation, a sole proprietorship or a partnership in Canada. Each corporation is assigned only one Business Number but multiple accounts can be opened up under this number. Purchase Now What is the Purpose of the Federal Business Number

Canada Revenue Agency Gst payment 如何在官网付GST YouTube

You may be required to: Register your business for the GST and QST. Collect the taxes from your clients. Calculate any input tax credits (ITCs) and input tax refunds (ITRs) you may be entitled to. File GST and QST returns for every reporting period. Special cases under the GST/HST and QST systems

How to Register for GST/HST in Canada for Your Small Business YouTube

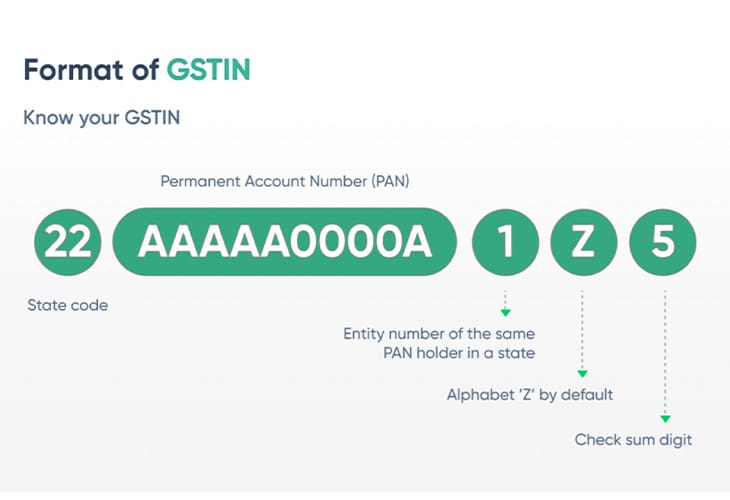

Learn about Tax in Canada. Validate GST/HST numbers, comply with E-invoicing & Digital Reporting, & more. Fonoa: Indirect tax technology for global businesses. Products. Lookup Instantly validates tax ID numbers . Tax Determines tax rates. Invoicing Issues locally. Canadian GST/HST Number Format. Individuals: TIN is referred to as the Social.

A complete guide for a Taxpayer on "How to check GST Number?"

An importer number-aka your business number, GST number, or 'RM' number-is required to import into Canada. 45 million parcels and pallets enter Canada each year, and to keep track of all that cargo, Customs uses your business number (or 'importer number') for identification and compliance. Simple enough! but who is the importer?

How to check GST number online? verify GST no. YouTube

To validate such a QST registration number, contact the CRA at 1 800 959-5525. 5. Digital Economy - Non resident - The Simplified GST Regime & the Specified QST System. Some GST and QST registration numbers may not give rise to an input tax. This situation will occur when dealing with the digital economy performed by non resident vendors who.

How to Complete a Canadian GST Return (with Pictures) wikiHow

Here's the process broken down: Contact the CRA and register for a number. Collect the correct amount of GST/HST from clients. Put aside the tax in a special bank account so you don't touch it. Spend GST/HST on business expenses. Tell the CRA how much you collected and how much you spent. Pay the CRA the difference.

How To Apply For A GST Number? Loans Canada

When requesting a new vendor (supplier) account in the University's financial system, if the supplier operates in Canada part of the validation process includes checking the Canada Revenue Agency's (CRA) registry. To avoid delays, include a screenshot of a successful validation in your supporting documentation by using the GST/HST Registry Search. Here is a short video tutorial [ Read More ]

GST Number Check How to Search GST Number Online?

New rules for digital economy businesses are in effect as of July 1, 2021. This information is for digital economy businesses that are not resident in Canada but that need to register for the purposes of Canada's GST/HST and charge the tax on supplies made in Canada.