The Complete Guide to Doji Candlestick Pattern

What Is Doji Candlestick? How To Use Doji Candlestick Patterns

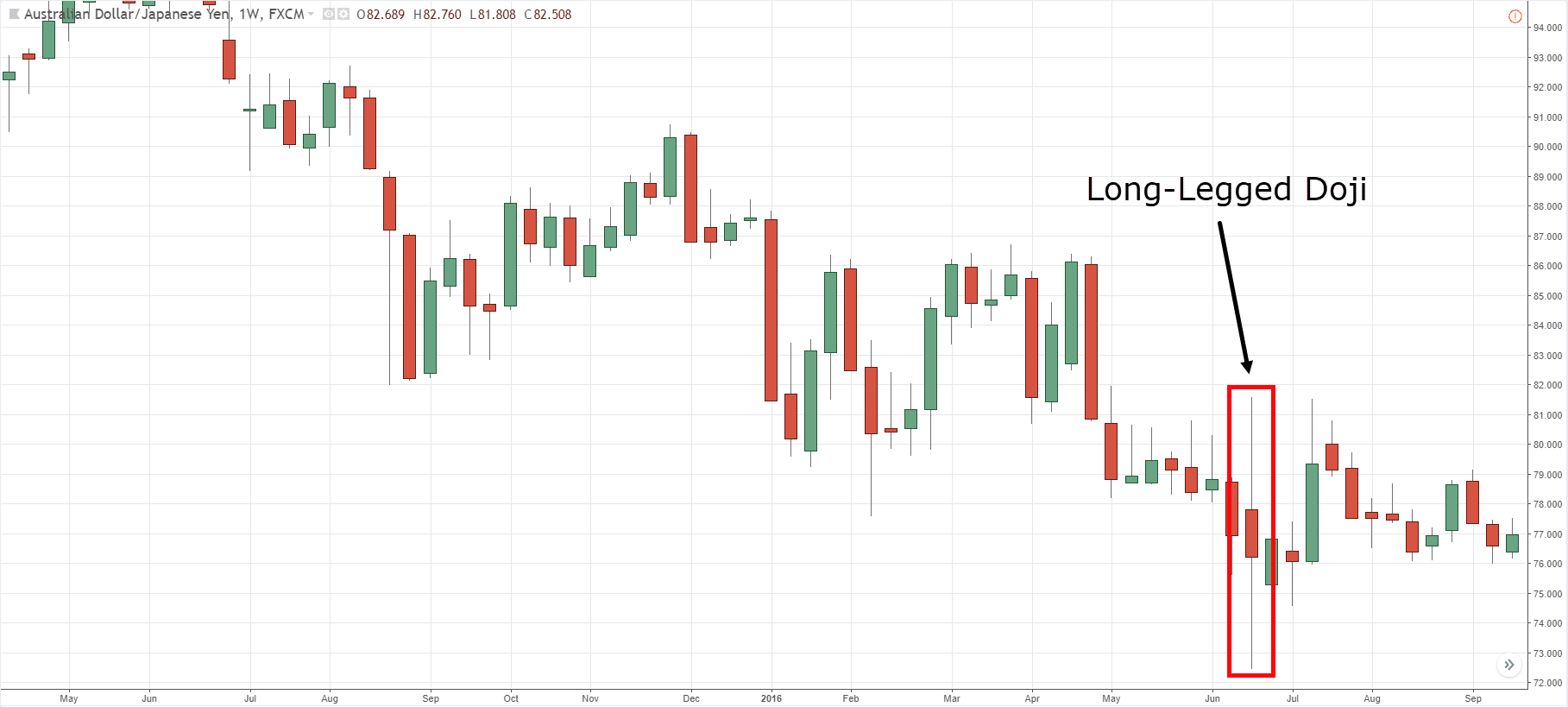

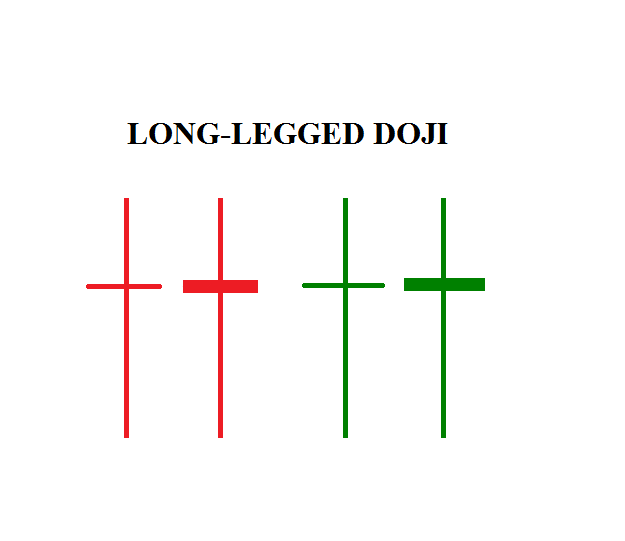

The long-legged doji is a candlestick that consists of long upper and lower shadows and has approximately the same opening and closing price. The pattern shows indecision and is most.

LongLegged Doji

The long-legged doji is a type of doji candlestick pattern with an extensive range. The long-legged doji candle gets its name based on how it appears on a candlestick chart-a doji with long legs. The long-legged adjective doesn't provide insight into how to run with this pattern.

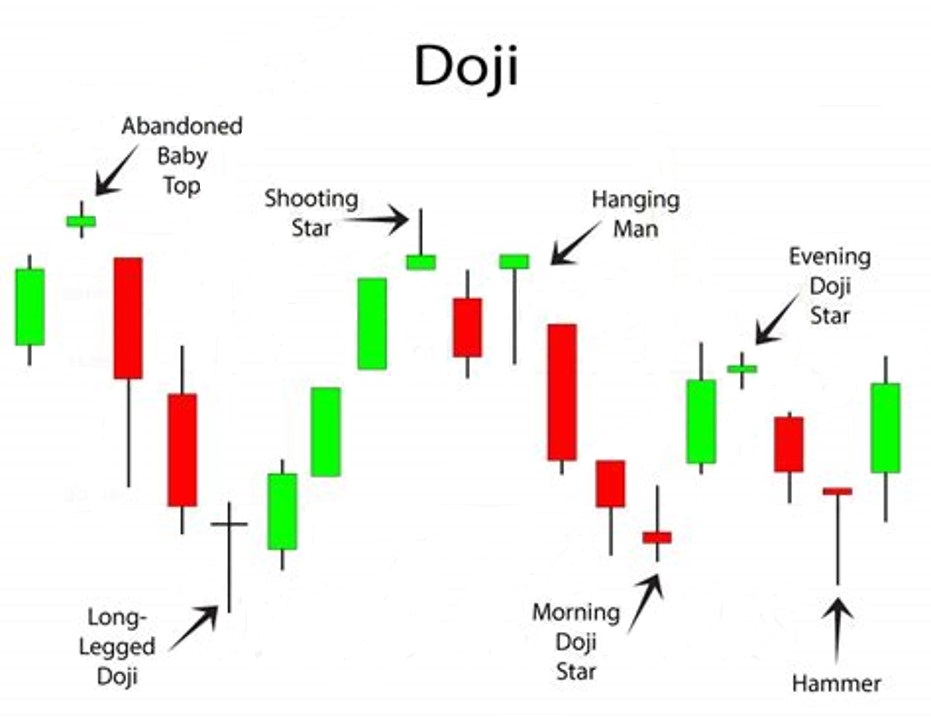

Top 5 Types of Doji Candlesticks

The long-legged doji is a one candle pattern in Japanese candlestick charting that signals a potential exhaustion of the pre-existing trend. It is a long legged candlestick that has long wicks on both the top and bottom, and a small body that is located in the middle of the candle's range.

The Complete Guide to Doji Candlestick Pattern

Definition Long-legged Doji candlestick is a type of Doji candlestick that has a long lower and upper wick. All the Doji candlesticks have the same opening and closing price. The high and low make a difference between types of Doji. Long-legged Doji represents indecision in the market.

Mastering Long Legged Doji Candlestick Patterns Tips for Day Traders FinGrad

What is the long-legged doji candle? A long-legged doji candlestick pattern looks like a cross. Here's how it can be broken down: 1. The body is very tiny or doesn't exist. 2. The close and open prices are in the candle's mid-range What does it say about the market?

The Complete Guide to Doji Candlestick Pattern

A long-legged doji candlestick pattern is one such pattern that affirms the market has entered a period of indecision with no viable direction in price action. What Is A Long Legged Doji Candlestick? A part of the Doji family, a long-legged doji candlestick is formed when the opening and closing prices are the almost the same.

O que é castiçal Doji? Como identificar e comércio How To Trade Blog

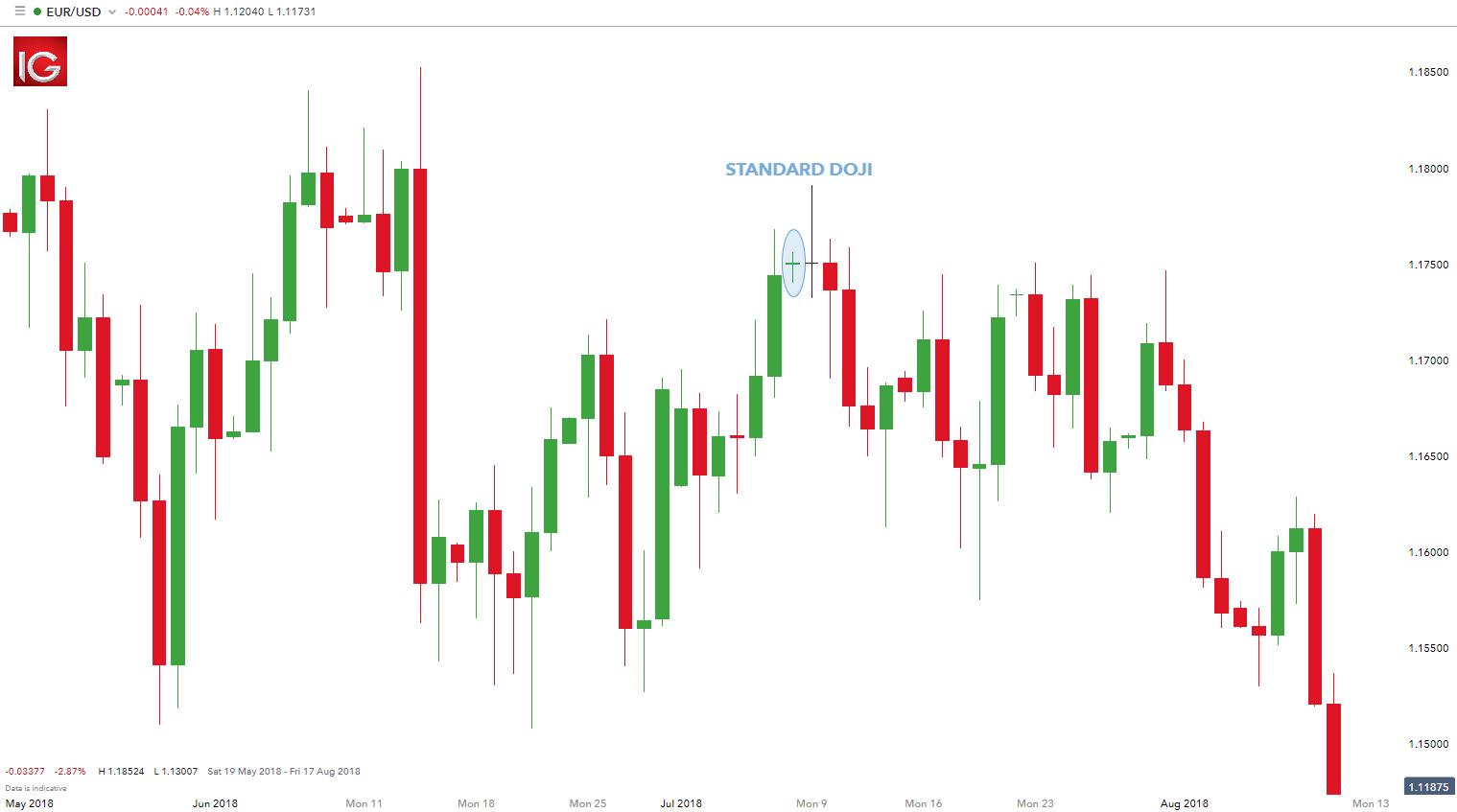

The Doji candle is the point on a candlestick chart where the opening and closing security prices become equal, temporarily keeping the market in equilibrium. The candlestick chart can form different Doji patterns depending on the price trends. The four main types of Doji patterns commonly seen are - common, gravestone, long-legged, and.

√ Mengenal Candlestick Doji dalam Trading Forex

The long-legged doji candlestick pattern is a single-candle pattern that is characterized by little or no real body and long upper and lower shadows. This pattern occurs in a market with high volatility and price fluctuations. It indicates market indecision in a spiky volatile market.

Understanding the LongLegged Doji Candlestick Pattern Market Pulse

FXOpen 12 Jul 2023, 10:37 Traders in financial markets are often intrigued by the long-legged doji, a candlestick pattern that stands out due to its distinctive shape and position on charts.

What are the many forms of Doji Candlesticks and how can I trade them? FOREX NATION SIGNALS

As mentioned above, the long-legged doji is a candlestick pattern that pimples that the price opened, rose or declined, and then ended at where it opened at. Ideally, the pattern can be in either of the colors. The long-legged doji typically says that there is an overall indecision among traders. It also means that there is more activity in the.

Long legged Doji Candlestick A Trader's Guide ForexBee

This article is devoted to the Long-Legged Doji basic candle. The literature contains many descriptions about doji candles that provide examples of schematic thinking. It is widely accepted that doji candles are neutral. However, it is an extremely important type of candle which should be interpreted differently for different types of situation.

Long Legged Doji Candlestick Pattern Best Analysis

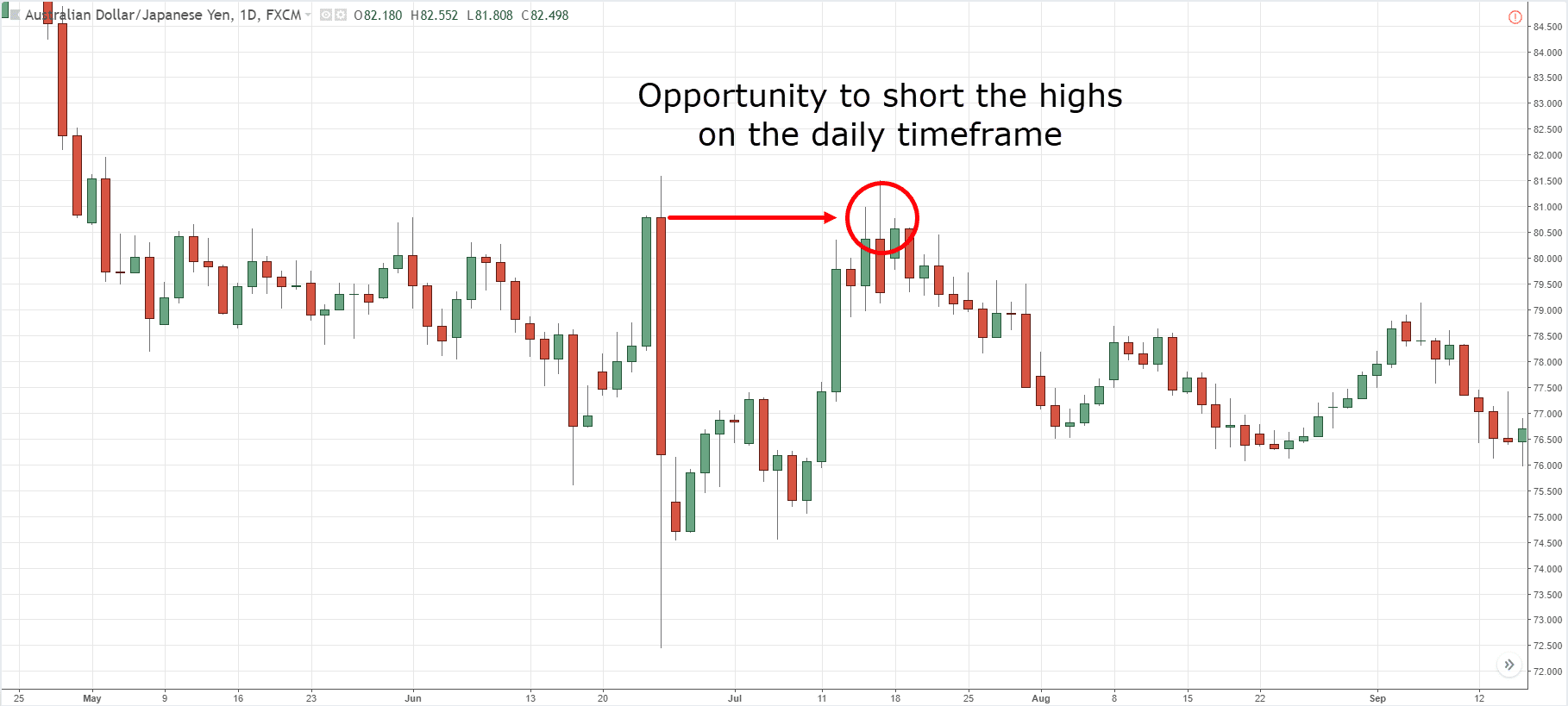

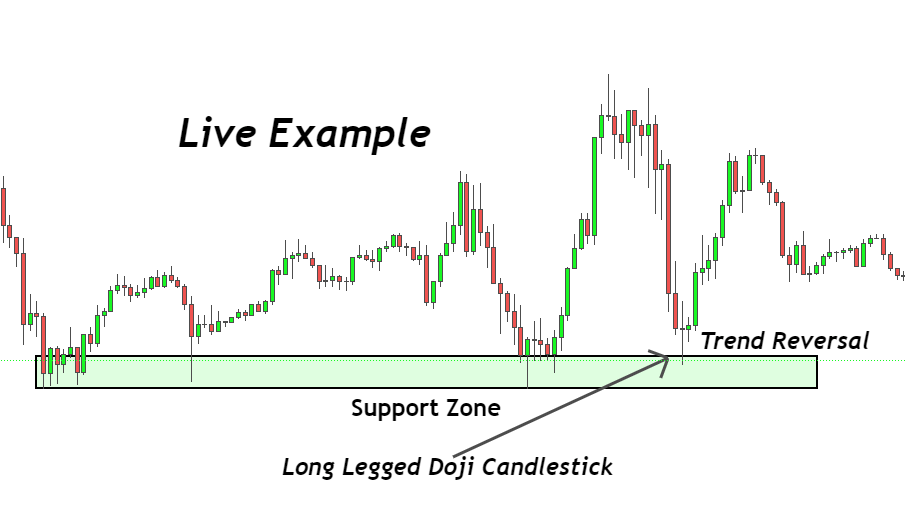

The Long-Legged Doji is a significant candlestick chart pattern in trading, indicating market indecision and potential trend reversals. Traders can identify and interpret this pattern using various techniques and combine it with other tools such as Bollinger Bands, volatility filters, and oversold/overbought conditions.

Bearish Long Legged Doji Candlestick Forex Trading

The Long-Legged Doji is a 1-bar candlestick pattern. It has a small body and long upper and lower shadows. It reflects indecision in the market. What you'll discover in this article ++ show ++ 1 How to identify the Long-Legged Doji candlestick pattern? 2 What does this pattern tell traders?

How To Read Different Types Of Doji Candlestick Pattern

Key takeaways Frequently Asked Questions What is the Long-Legged Doji Pattern? The long-legged Doji is a Japanese candlestick pattern that signals market indecision. It consists of a single candle with long wicks and exact or approximate opening and closing prices. In partnership with Friends cashed in on GameStop, while you were playing games?

Mastering Long Legged Doji Candlestick Patterns Tips for Day Traders FinGrad

A Long Legged Doji is a type of Doji candlestick pattern with longer wicks that indicate a price reversal. The Long Legged Doji has long upper and lower shadows, indicating that there was significant price movement during the period. The below image depicts how the pattern looks,

:max_bytes(150000):strip_icc()/dotdash_Final_Dragonfly_Doji_Candlestick_Definition_and_Tactics_Nov_2020-01-eb0156a30e9745b687c8a65e93f54b07.jpg)

The LongLegged Doji Trading the Right Candlestick Pattern

What is a Long-Legged Doji Candlestick? Long-legged doji candlesticks are one of four types of dojis -- common, long-legged, dragonfly and gravestone. All dojis are marked by the fact that prices opened and closed at the same level.