How To Trade Blog What Is Three Inside Up Candlestick Pattern? Meaning

What Is Three White Soldiers Candle Pattern? Meaning And How To Use

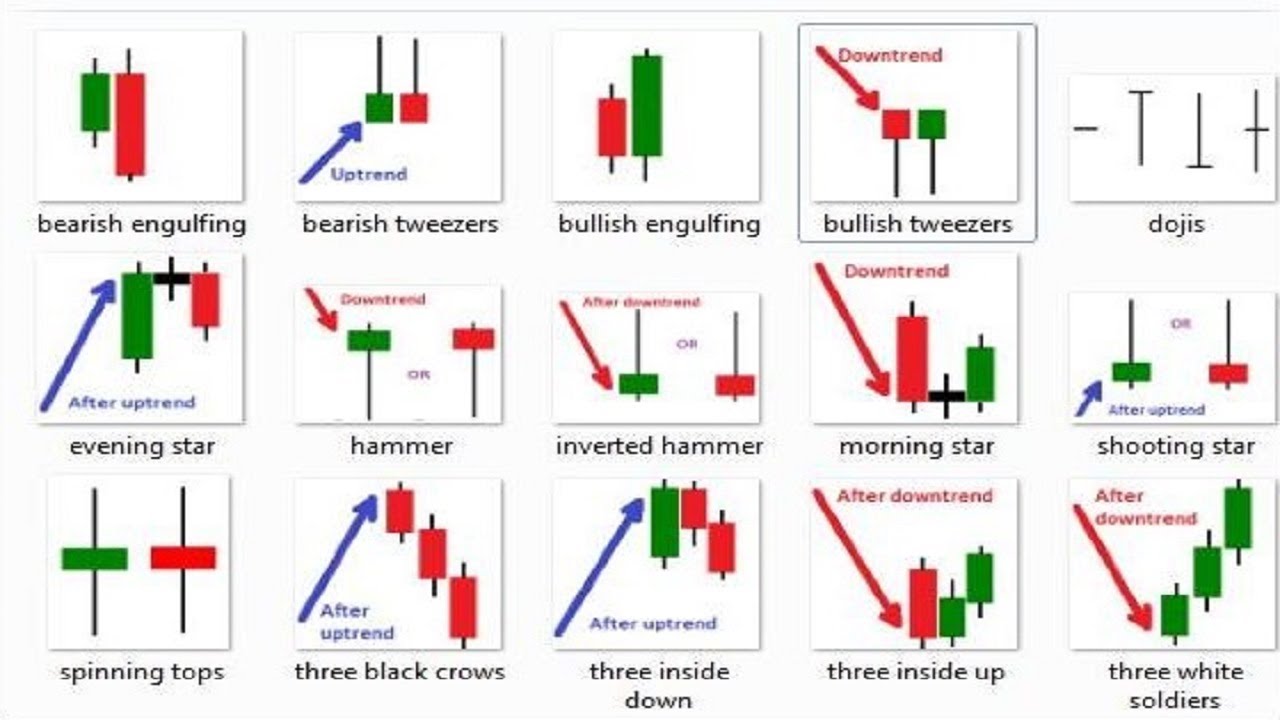

The three inside down candlestick pattern is the opposite of the three inside up pattern and indicates a trend reversal found at the end of an uptrend. The following chart shows an example of a three inside down pattern: The first candlestick is long and bullish, indicating that the market is still in an uptrend.

Bullish Rising Three Methods Candlestick Candle Stick Trading Pattern

https://www.thetradingchannel.com/500offI am looking for 500 new or struggling traders to mentor and help accomplish their trading goals throughout the remai.

An Overview of Triple Candlestick Patterns Forex Training Group

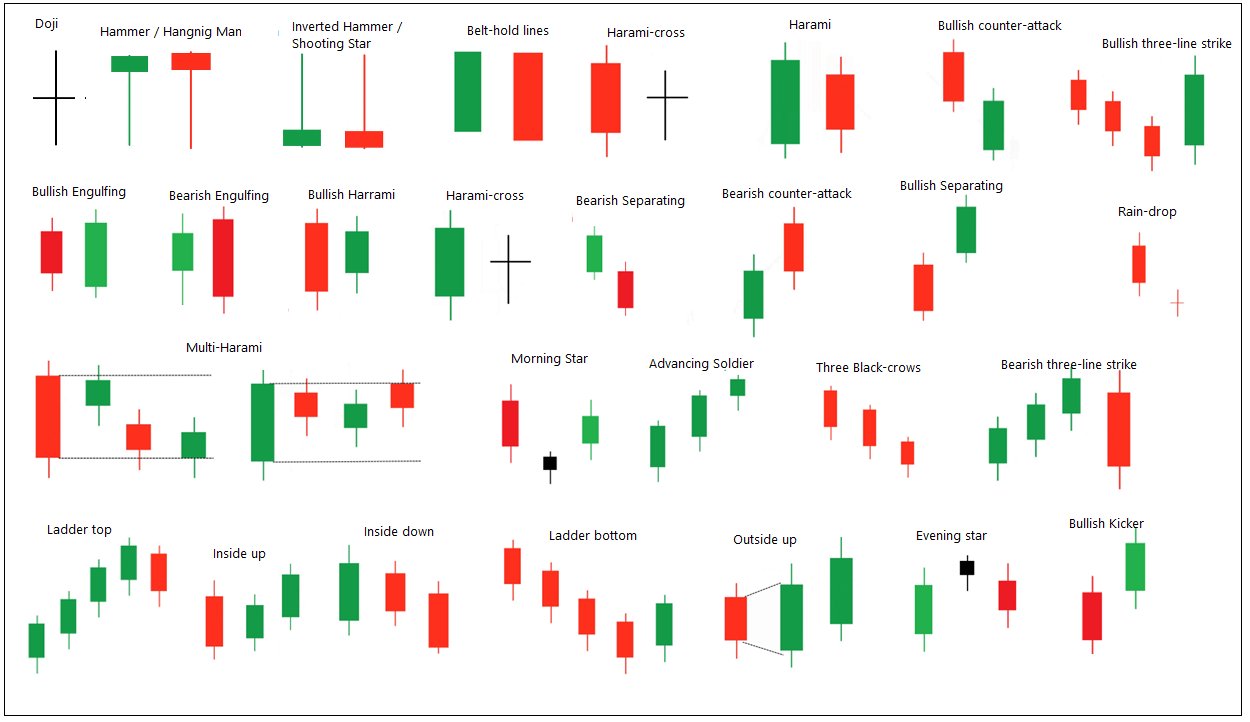

Three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Traders use it alongside other technical indicators such as the relative strength index.

145 CANDLESTICK PATTERNS PAGE 9 (17) Morning Star ( Bullish

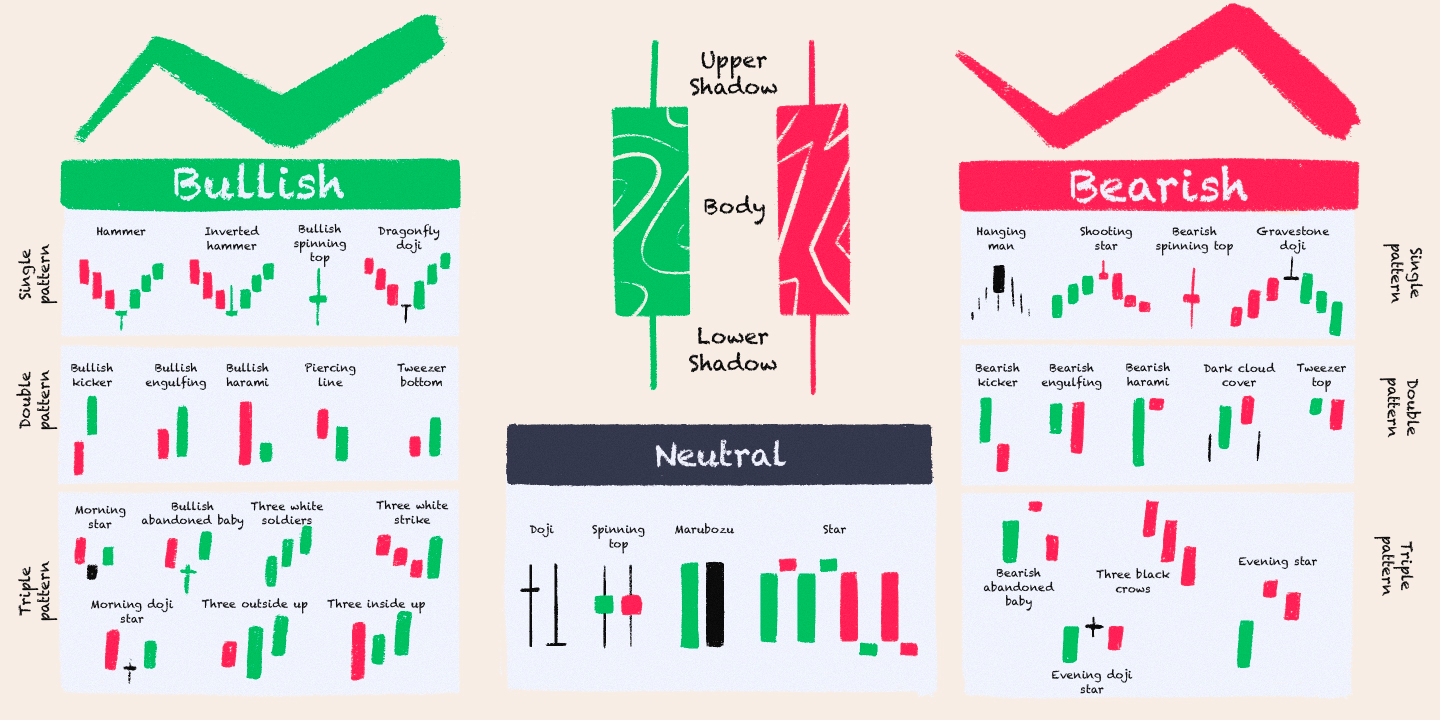

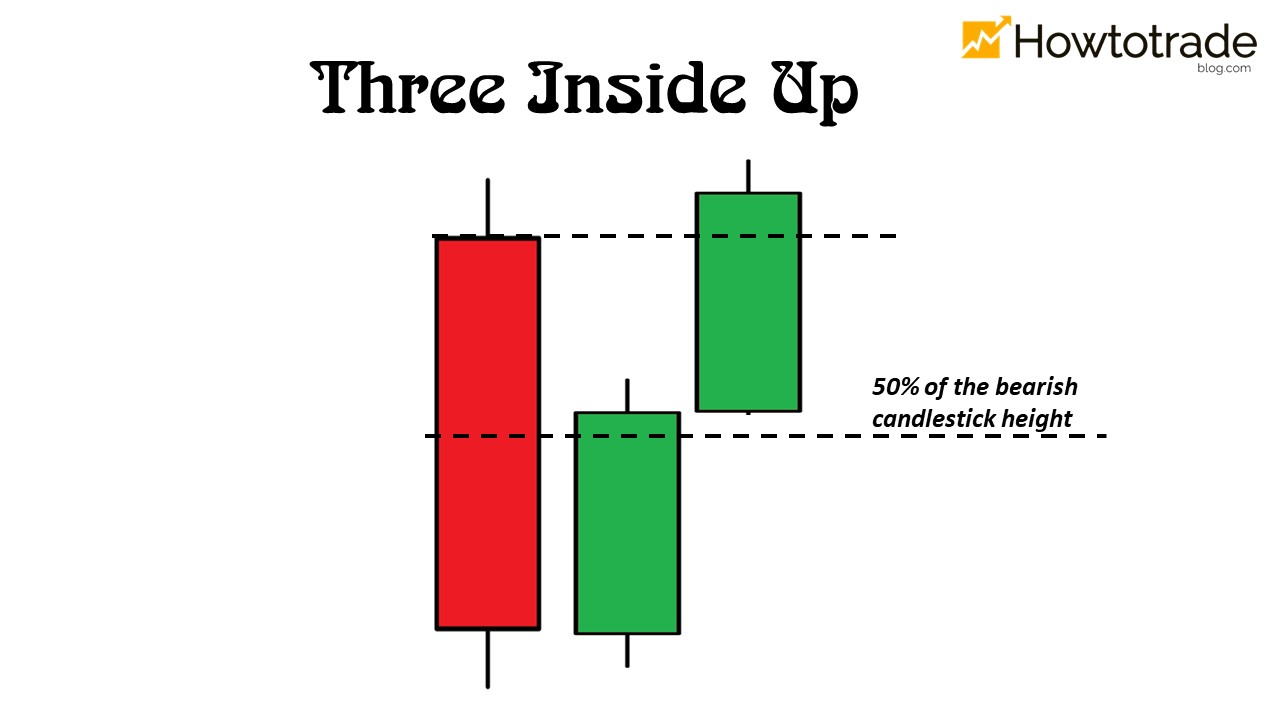

The Three Inside Up candlestick formation is a trend-reversal pattern that is found at the bottom of a DOWNTREND. This triple candlestick pattern indicates that the downtrend is possibly over and that a new uptrend has started. For a valid three inside up candlestick formation, look for these properties:

10 Price Action Candlestick Patterns Trading Fuel Research Lab

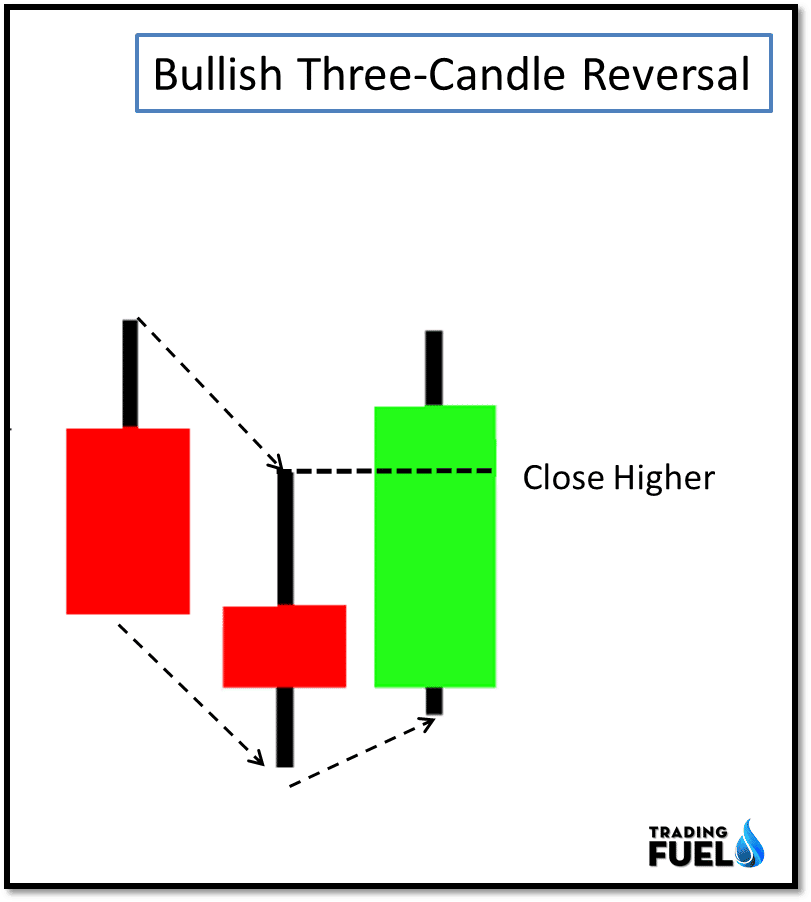

What Is a 3 Outside Up/Down? The three outside up and three outside down are three-candle reversal patterns that appear on candlestick charts. The pattern requires three candles to form.

MOST COMMON CANDLESTICK PATTERNS for FXEURUSD by Lzr_Fx — TradingView

This 3-candle bullish candlestick pattern is a reversal pattern, meaning that it's used to find bottoms. For this reason, we want to see this pattern after a move to the downside, showing that bulls are starting to take control. When a Morning Star candlestick pattern appears at the right location, it may show:

Candlestick Patterns The Definitive Guide [UPDATED 2022]

Preview E Jun 2022 · Your Journey to Financial Freedom Save on Spotify The candlesticks are used to identify trading patterns that help technical analyst set up their trades. These candlestick patterns are used for predicting the future direction of the price movements.

D Shawna Jackson Evening Star Candlestick Pattern Chartink

A tri-star is a three line candlestick pattern that can signal a possible reversal in the current trend, be it bullish or bearish. Tri-star patterns form when three consecutive doji.

How to read candlestick patterns What every investor needs to know

The morning star pattern involves 3 candlesticks sequenced in a particular order. The pattern is encircled in the chart above. The thought process behind the morning star is as follow: The market is in a downtrend placing the bears in absolute control. The market makes successive new lows during this period.

Candlestick Patterns The Definitive Guide (2021)

Reliable Triple Candlestick Pattern #1: Morning Star and Evening Star. Both the Morning Star and Evening Star patterns comprise a combination of three candlesticks, but they signal opposite directional movement in a currency pair. When you see a Morning Star pattern, you should consider it to be a bullish signal.

Candlestick Patterns Explained with Examples NEED TO KNOW!

Candlestick patterns are part of a way to represent market prices : the candlestick charts. The best way to chart candlestick is using the TradingView solution. It lets you chart candlestick and all other charting types and you can try it now for free.

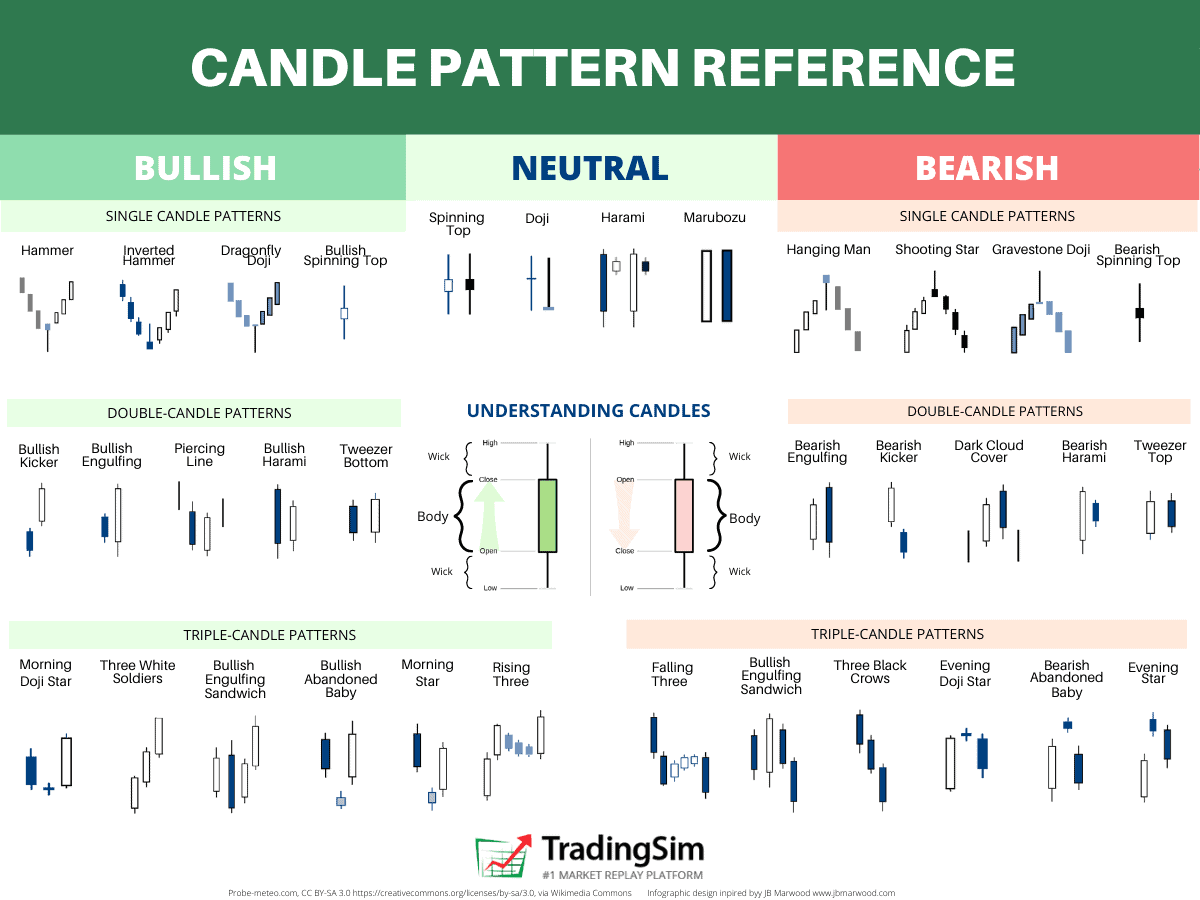

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

According to Investopedia.com, it is commonly believed that candlestick charts were invented by a Japanese rice futures trader from the 18th century.His name was Munehisa Honma. 2 Honma traded on the Dojima Rice Exchange of Osaka, considered to be the first formal futures exchange in history. 3 As the father of candlestick charting, Honma recognized the impact of human emotion on markets.

How To Trade Blog What Is Three Inside Up Candlestick Pattern? Meaning

The three white soldiers pattern can appear after an extended downtrend and a period of consolidation. The first candlestick of the chart pattern that needs to appear is a bullish candlestick with.

3 candlestick patterns outlet factory shop

A candlestick is a way of displaying information about an asset's price movement. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. This article focuses on a daily chart, wherein each candlestick details a single day's trading.

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

Understanding the Three Inside Up/Down Candlestick Patterns The up version of the pattern is bullish, indicating the price move lower may be ending and a move higher is starting. Here are.

How To Trade Blog What Is Three Inside Down Candlestick Pattern

The three crows pattern, also referred to as the "three black crows", is a reversal pattern found at the end of an uptrend. The three crows pattern forms as follows: It consists of three consecutive bearish candlesticks. The bodies of the second and the third candlestick should be approximately the same size. They have .